5 Key Learnings from Techmagnate’s Demat & Stock Trading Search Trends Report

February 15, 2024

Sarvesh Bagla

Summary: This blog post gives detailed insights from Demat and Stock Trading Apps Search Trends Report.

In today’s fast-paced financial world, understanding the dynamics of trading is crucial for businesses and professionals. To understand how investors behave when they’re looking to buy or sell stocks, we have worked on a comprehensive report.

As we embark on this journey through the report’s findings, we encounter five key takeaways that stand out as a source of actionable intelligence. These takeaways not only shed light on investor preferences but also provide a framework for anticipating market shifts and adapting strategies accordingly.

In essence, Techmagnate’s Demat and Stock Trading Apps Report arms businesses and professionals with the knowledge needed to navigate the exciting world of stock trading.

Demat Account Growth in India

Back in 1996, the introduction of dematerialization in India was a big move in the financial sector.

Before, investors had to deal with physical certificates for their securities, which was slow and risky. Dematerialization changed that by getting rid of the need for physical certificates, making it much easier to buy, sell, and hold securities. Since then, demat accounts have grown by a huge number in India.

According to the Securities and Exchange Board of India (SEBI), the number of Demat accounts in the country went from 1.2 million in 2000 to 139 million in December 2023. The growth in number shows how people are trusting trading as an alternative investment option to traditional ways of investments like real estate or gold.

With the market doing well and existing investors making good profits, new investors are joining in to catch the rising market wave.

Customer Preferences in the Trading Landscape

1. Rise in Searches for Demat & Trading

Our report highlights that the majority of searches for trading-related queries revolve around Demat and Trading (approximately 82.76%). As Mukesh Kochar, National Head Wealth, AUM Capital says FOMO is real in new investors.

In simpler terms, a large number of individuals in India are looking for information on online trading options. They want to educate themselves about the growing industry and be updated about the same.

2. Interest in Specific Searches

Individuals are exploring a wide array of topics, including demat account management, comparison of trading platforms, various investment options such as stocks and mutual funds, trading tips, demat account charges, upcoming IPOs, market news, and updates.

These diverse search queries reflect the varied interests and requirements of individuals seeking guidance in navigating the intricacies of demat and trading.

3. Trustworthy Leaders in the Market

Zerodha, Groww, and Upstox have emerged as popular names in the investing and trading domain. These brands have become the go-to choices for individuals conducting searches related to investment and trading activities.

Their prominence in the report suggests that they hold a significant position in the minds of people seeking information or platforms for their investment needs.

4. People Want to Know About Stocks

A 5.69% increase in searches related to just stock trading, reveals a growing interest among people in making money through regular trading along with long-term investments.

The uptick in this search indicates a keen desire among individuals to know more about different types of stocks and trading options. In the report, we have a list of the most searched stocks. Check the list here.

5 Takeaways for Brands and Marketers from Search Trends Report

1. People Are Changing How They Search

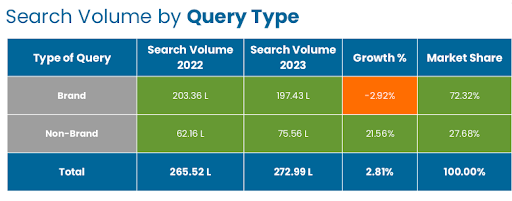

The report highlights a significant shift in search behavior, where people are increasingly using general terms rather than specific brand names.

For instance, the search volume for non-brand queries has seen a 21.56% increase, showcasing this notable change. Individuals are now more likely to conduct broader searches, such as “Demat” or “Trading,” rather than directly searching for specific brands like Zerodha or Upstox.

This shift indicates a growing interest in general information and a move towards understanding the overall market rather than focusing on individual brands.

2. Interest in Demat and Trading is Reaching Tier 2 Cities

Prominent metropolitan hubs like Delhi, Mumbai, and Bengaluru remain at the forefront of online searches, constituting a substantial portion of the search activity.

However, it’s noteworthy that smaller cities such as Jaipur, Lucknow, and Indore are experiencing a considerable surge in search volumes, with a growth rate of 4.19%, 13.86%, and 9.91% respectively.

Brands should recognize these changing trends and adjust their strategies to engage effectively with growing markets in big cities and up-and-coming urban areas.

3. More People are Trusting Apps

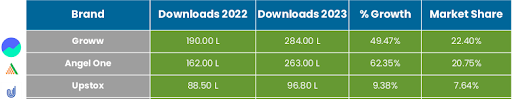

The report sheds light on a notable trend where a considerable number of users are opting to download trading apps such as Groww, Angel One, and Upstox.

Groww exhibited an impressive 49.47% growth in downloads from 2022 to 2023, indicating a substantial increase in user engagement. Similarly, Angel One and Upstox also experienced significant growth at 62.35% and 9.38%, respectively.

This surge in app downloads underscores a broader shift in user behavior towards mobile-centric trading platforms. The convenience, accessibility, and user-friendly interfaces offered by these apps seem to resonate with a growing audience.

There’s a rise in the importance of adapting to this mobile-first trend in the financial technology sector, where individuals increasingly prefer the flexibility and on-the-go access provided by trading apps.

4. People Want Information in Their Language

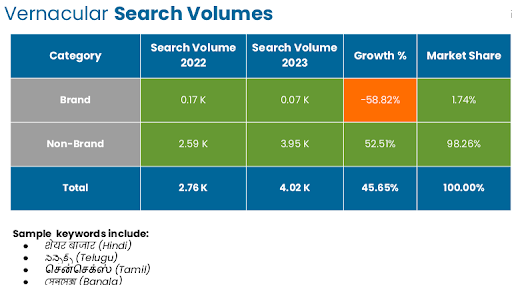

Another growing trend in user search behavior is an increased interest in local languages such as Hindi, Telugu, Tamil, and Bangla.

Vernacular language plays a crucial role in stock market searches by catering to the diverse linguistic preferences of users. By incorporating vernacular non-branded search terms, financial information becomes more accessible and inclusive. This will enable a broader audience to participate and understand stock market trends, investment opportunities, and related topics.

5. Big Brands are Ruling the Search Game

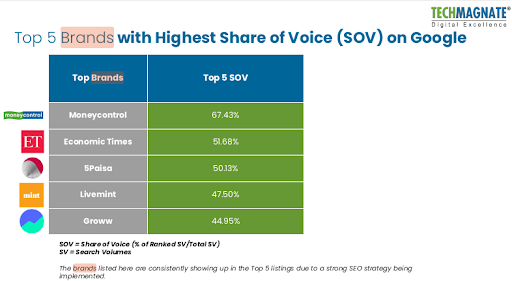

Online platforms like Moneycontrol, Economic Times, and 5Paisa emerge as prominent influencers in the search for stock trading, capturing significant attention.

- Moneycontrol: With a significant SOV of 67.43%, Moneycontrol dominates the online space in terms of visibility in finance-related searches. This suggests that it is a highly trusted and frequently sought-after source of financial information and services among users.

- Economic Times: With an SOV of 51.68%, Economic Times holds a strong position as one of the top brands in demat and trading searches. Its presence indicates that users often turn to the Economic Times for related news, analysis, and insights.

- 5Paisa: At 50.13% SOV, 5Paisa emerges as another prominent player in the online finance landscape. Its strong presence suggests that it is gaining traction as a preferred platform for online trading and investment services.

- Livemint: With an SOV of 47.50%, Livemint commands a significant share of online attention in trading-related searches. This indicates that it is a trusted source for financial news, market updates, and analysis among users.

- Groww: With an SOV of 44.95%, Groww also holds a notable presence in online finance searches. Its appearance in the top 5 suggests that it is gaining popularity as a platform for online investing and management services.

Learning from the success stories of these brands can serve as a valuable guide for other competitors aspiring to make a mark in the online stock trading list.

What These Insights Mean for Brands

- Be Ready to Change: Brands should be prepared to adapt their outreach strategies. What resonated with the audience last year might have a different impact this year. The dynamic nature of the market demands flexibility and a willingness to evolve.

- Think Local: To expand their reach, brands should consider tailoring their approach to different cities. While major cities like Delhi, Mumbai, and Bengaluru continue to lead, the rising search activity in smaller cities like Jaipur and Lucknow presents an opportunity for brands to connect with diverse markets.

- Get Mobile-Friendly: Given the surge in downloads of trading apps like Groww, Angel One, and Upstox, brands must ensure that their digital presence is optimized for mobile users. This involves not only looking good but also ensuring smooth functionality on mobile devices.

- Speak in Different Languages: With a rising interest in languages like Hindi, Telugu, Tamil, and Bangla, brands should consider diversifying their content to cater to linguistic preferences. Delivering information in the language most comfortable for the audience can enhance engagement and connection.

Techmagnate’s report is like a digital tool for brands trying to make it in the investing world. By understanding what people are looking for, brands can make sure they’re on the right track in their digital marketing strategy.

With each takeaway, a clear path forward emerges. Brands that apply these insights stand to thrive in the ever-changing landscape of demat and stock trading.

In today’s knowledge-driven world, Techmagnate’s report arms brands with the information needed to adapt and succeed. By embracing these insights, brands can position themselves as leaders, earning the trust of investors and driving sustained growth.

Let’s not just acknowledge these insights, but use them to chart a course toward success in demat and stock trading. With strategy and insight, success is inevitable.

Refer to our search trends report for more exciting and valuable insights from the demat and stock trading world.

Download here.