Mutual Funds Search Trends for Marketers and Lenders

January 29, 2024

Neha Bawa

Summary: This blog post gives detailed insights from Techmagnate’s Mutual Funds Search Trends Report.

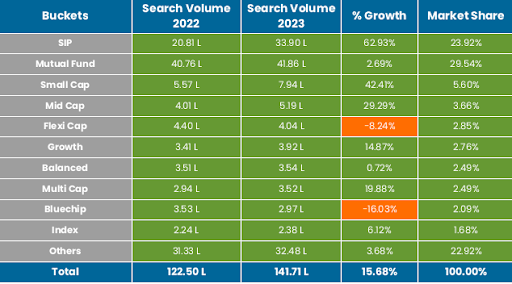

The Indian investment landscape is booming with 141.71 L searches for Mutual Funds in 2023. A tech-savvy generation and a growing appetite for wealth creation fuel this growth.

But in this crowded market, how do you make an asset management company (AMC) the go-to destination for potential investors? The answer lies in understanding the digital journey of a consumer – their online searches, questions, and preferences.

This is where our latest report, Mutual Fund Search Trends 2023, becomes a valuable tool.

We’ve analyzed over 17,000 keywords, revealing the search behaviors and aspirations of Indian investors, and we’re ready to share these insights with you.

Mutual Funds Market: An Overview

More and more Indians are looking for mutual funds online, with searches jumping 15.68% from 2022 to 2023. In 2023, the mutual fund industry experienced significant growth, adding a record Rs 10 trillion to its total assets under management (AUM). This brought the cumulative total to over Rs 50 trillion for the first time by December.

This shows people are increasingly investing their money wisely in mutual funds and SIPs.

Due to this surge in demand, It becomes imperative to understand what type of funds people are searching for and where they’re looking. Lending institutions can offer the right options and attract these investors by leveraging search insights into their digital marketing efforts. It’s a win-win situation for both brands and marketers.

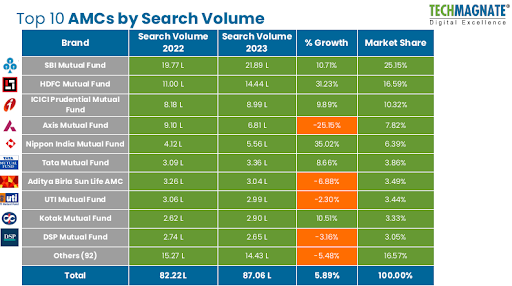

Top 10 AMCs by Search Volume

Here we see the performance of the top 10 Asset Management Companies (AMCs) based on search volume, growth percentage, and market share for the years 2022 and 2023.

- SBI Mutual Fund leads in both search volume and market share, showing a growth of 10.71%. HDFC Mutual Fund follows with substantial growth at 31.23%.

- Notably, Axis Mutual Fund experienced a decline in search volume and growth.

- The overall industry witnessed a 5.89% growth in search volume, with SBI Mutual Fund holding the highest market share.

Top 5 Brands for Mutual Funds (Based on SOV)

This list above highlights the top 5 brands with the most visibility on Google, known as Share of Voice (SOV). SOV is the percentage of a brand’s presence compared to the total in a specific category.

Groww leads with 80.72%, followed by ET Money (50.80%), Cleartax (42.46%), and Sipcalculator.In (26.56%), and Upstox (26.46%).

These brands consistently rank high due to their strong online visibility, thanks to the smart SEO strategies they’ve implemented.

Mutual Funds Search Trends Ruling for 2024

There are notable trends shaping the landscape of mutual funds searches. Let’s uncover these in detail.

1. Rise in Branded and Non-branded Keyword Volumes

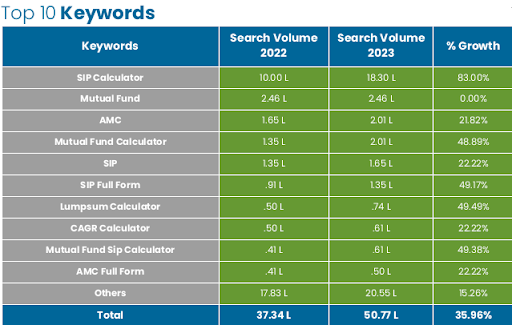

Investors are becoming more specific in their online searches. The interest in “SIP Calculator” has shot up by 83%, indicating a keen desire to understand and optimize Systematic Investment Plans. Additionally, searches for the “Best Mutual Funds for Retirement” have increased by 52%, reflecting a shift towards long-term planning.

In the mutual funds space, there is a clear preference for certain types. Small Cap funds and Hybrid Equity Funds have seen rises of 42% and 38%, respectively, suggesting an interest in potential high-growth smaller companies and balanced portfolios.

When it comes to specific brands, HDFC Mutual Fund and Nippon India Mutual Fund are leading the search game with increases of 31% and 35%, respectively. This shows that investors are not only interested in the types of funds but also in the reputation and performance of specific mutual fund brands.

2. Platform Preferences and User Behavior

When it comes to what people like and how they behave online, a few things stand out.

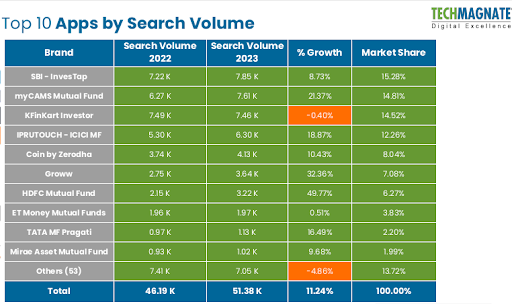

Firstly, a lot of people are searching for mutual funds on platforms, and Groww is leading the pack with a whopping 107.32% increase in searches, followed by Coin by Zerodha with a 21.69% boost. It’s a good idea for financial institutions to make sure they’re visible and offering their best on these platforms.

Secondly, people are really into using mobile apps to look for mutual funds, with an 11.24% increase in searches. So, businesses should focus on making their app experience great and include features that work well on mobile.

Lastly, there’s a trend towards looking for things nearby, with an 18.90% increase in “near-me” searches for mutual funds. To keep up, businesses should think about local marketing and teaming up with local advisors. Paying attention to these trends is crucial for success in the world of digital investing.

3. Local Searches Take the Lead

In focusing on local trends, some important numbers stand out.

Geographically, Mumbai is at the forefront with a 10.56% growth in mutual fund searches, followed by Delhi (8.23%) and Bengaluru (7.91%). This highlights the importance of tailoring outreach strategies to meet the specific needs of these metropolitan cities.

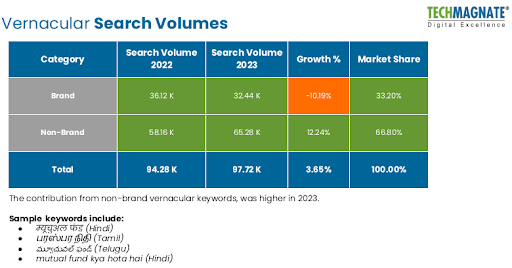

Non-brand vernacular keywords saw significant growth in 2023 compared to brand keywords. This shift signifies a crucial trend in search behavior: users are increasingly seeking information in their native languages and using natural, everyday terms.

12.24% growth in non-brand vernacular keywords vs. -10.19% for brand keywords: This stark contrast highlights the growing preference for local and relatable search queries.

66.80% market share for non-brand vernacular keywords show dominance. There is a major shift in user behavior, where relying solely on brand terms is becoming less effective.

Examples like “mutual fund kya hota hai” (Hindi) and “ம ్యూచుவல் ఫండ్” (Telugu) showcase how users are searching for complex topics using their native languages and everyday phrases.

The takeaway from these search trends is clear – businesses should embrace a localized approach by adapting to these statistics. This not only enables more meaningful connections with investors but also positions businesses strategically in alignment with the preferences and behaviors of different demographics and regions.

Harnessing the Power of Mutual Funds Search Insights

Lenders and marketers can harness the power of these search insights to refine and optimize their strategies for greater effectiveness.

By incorporating these insights into their approach, lenders and marketers can maximize their impact, resonating more effectively with specific demographics and regions, ultimately driving growth and customer satisfaction.

Now, let’s discuss strategies:

For Marketers:

- Craft targeted campaigns to resonate with the search intent of the investor. Use high-growth keywords and tailor your content to specific investor segments based on their preferred platforms, formats, and information needs.

- Optimize your platform for a seamless user experience. Streamline the user experience to cater to the increasing number of mutual fund searches and ensure effortless navigation.

- Build strategic partnerships with famous platforms and financial influencers. Collaborate with rising stars in the fintech space to expand your reach and leverage expertise.

For Lenders:

- Personalize your outreach strategy. Target the right audience by understanding their demographics, city-specific trends, and preferred platforms.

- Partner with rising brands and offer the investment options and features users crave.

- Refine your digital offerings by optimizing your online presence to cater to the growing demand for mobile-friendly solutions and “near-me” searches.

The future of mutual funds growth lies in understanding customer’s digital journey. The numbers and consumer insights in this report tell a compelling story about investors’ search. It’s a guide to understanding and unlocking the strategies behind investor requirements and needs.

Whether you want to know more about top brands people trust, find the top funds investors are searching for, or explore city-wise data, this report provides hidden insights that should be leveraged for a competitive advantage.

By leveraging the rich insights from our Mutual Fund Search Trends Report, you can craft targeted strategies, create a seamless user experience, and unlock your full potential in this financial market.

Download your copy of the report today and start decoding the path to success.

Contact us if you want to know how to leverage these search insights for your industry.