Home Loan Marketing Ideas Featuring Search Trends Insights from Techmagnate

January 15, 2024

Prashant Shukla

Summary: Explore India’s home loan search insights and trends in-depth. Plus, discover effective marketing strategies designed for brands to use this data and expand their reach.

In evolving industries like home loans, understanding what potential borrowers are searching for online is the golden ticket to successful marketing. Gone are the days of generic ads; today, data-driven insights are the actual currency and true power for marketers.

Here is where an understanding of evolving consumer needs in Techmagnate’s Home Loan Search Trends Report comes in. The data in the report clearly shows the interests of your target audience, revealing specific customer inquiries and requirements.

We urge brands and marketers to harness the insights from this report to strengthen their digital marketing campaigns and build a better SEO strategy.

Targeted campaigns, driven by these search insights, can open a doorway for brands to deeply connect with, attract, and convert potential home loan buyers. By addressing the audience’s specific needs and preferences, these campaigns can significantly enhance engagement and conversions within the competitive home loan market.

Search Landscape in the Home Loan Industry

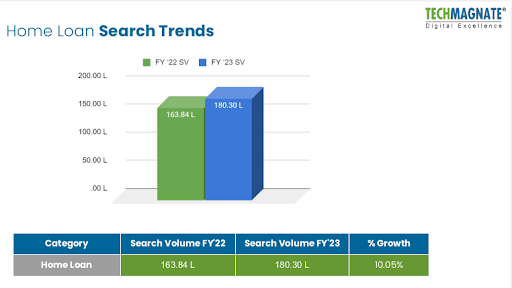

The search trend report states that the ‘home loan’ search volume has increased by 10.05% from FY’22 to FY’23, with the current volume being 180.30 lakh. This indicates a growing interest and demand for home loans in the market.

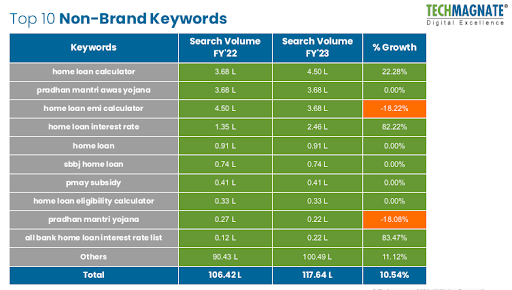

Furthermore, interest rates are a rising concern, as we see embedded in the searches for “home loan interest rate calculator” soaring by a whopping 82.22% compared to last year (2022). EMI calculators are also in high demand, growing by 15.29%, showing people’s increasing focus on affordability.

Brand searches (those mentioning specific brands like SBI or HDFC) grew by 9.66% and now account for 34.75% of the total search volume. Non-brand searches (more general terms like “home loan” or “best home loan”) dominate with 65.25% of the market share.

A significant portion of brand-specific searches highlights the importance of building brand recognition and visibility for home loan providers. Whereas, non-brand searches remain crucial, suggesting that many people are still exploring options and open to different providers.

For more search insights, download the home loan search trends report.

Using Search Trends Insights to Create Strong Digital Marketing Strategies:

We came across some interesting data while creating the report and it speaks volumes about the window of opportunity available to marketers.

Here are some ways that brands can leverage these search trends to connect more closely with their target audience.

1. Create Content that Speaks Volumes

Forget generic sales pitches – the home loan market craves education and valuable resources; in other words, they want clear and transparent information from their lending institutions and loan providers.

It’s time for brands to go easy on the hard sell and become trusted guides for their target audience by openly answering their questions and equipping them with knowledge for making a more informed decision.

Leveraging these search insights into content creation:

- Create an “Ask the Expert” series. Address common search queries like “How much down payment do I need?” or “What are closing costs?” in bite-sized, informative videos or blog posts.

- Develop a user-friendly EMI calculator. Go beyond the basic calculator. Offer features like comparing different loan options, factoring in prepayments, and visualizing repayment schedules. This will keep borrowers engaged and build trust in your expertise.

- Craft infographics on complex topics. Break down intricate concepts like fixed vs. floating rates or prepayment penalties into visually appealing infographics that simplify complex information.

2. Focus on Local SEO

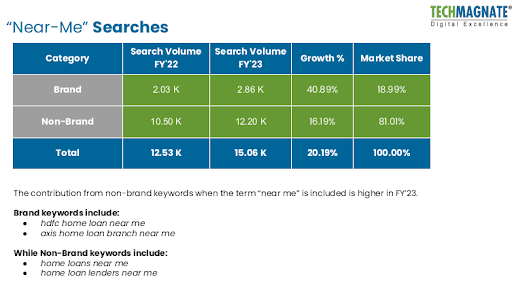

“Near me” searches are on the rise, with people actively seeking lenders within their immediate vicinity. This presents a golden opportunity for brands to attract local borrowers and stand out from the crowd.

- “Near me” searches for home loans have grown by 25.74% in the past year (2022 – 2023), indicating a growing preference for local lenders. This trend is particularly strong in Tier 2 and 3 cities.

- City-wise data reveals significant variations in search volume. Mumbai leads the pack, followed by Delhi, Bangalore, Chennai, and Hyderabad. However, Tier 2 and 3 cities like Pune, Jaipur, and Lucknow are experiencing rapid growth in home loan searches, presenting untapped potential market.

Here are a few marketing tips to optimize your website and content for local dominance:

- Instead of adding generic and high-competition keywords like “home loan”; add “near me” and city-specific terms into your keyword targeting strategy. For example: “best home loan near me in Delhi,” or “home loan EMI calculator Mumbai.”

- Localize your landing pages. Create dedicated landing pages for each city you serve, highlighting your local branch network, special offers, and success stories from nearby customers.

- Optimize for voice search. Nowadays people increasingly use voice assistants like Siri or Alexa for local searches. Ensure your website and content are optimized for natural language queries like “What are the best home loan options near me?”

- Make sure your Google My Business listing is accurate and up-to-date, including photos, contact information, and service offerings. This will improve overall local search visibility and build trust with potential borrowers.

3. Campaigns that Click

By understanding exactly what borrowers are searching for, brands can craft marketing campaigns that hit the bullseye, attract qualified leads, and convert them into loyal customers.

- Interest rates continue to be a top search, accounting for a whopping 28.34% of all home loan searches. Price-consciousness is the name of the game, so highlight your competitive rates in your campaigns. Don’t be afraid to talk about special offers or limited-time discounts.

- “Home loan EMI calculator” is a close second, with 3.68 million monthly searches. Brands need to ease the burden of affordability with a user-friendly and intuitive EMI calculator. Make it prominent on your website and landing pages, and integrate it into your marketing materials.

- “Best home loan under 50 lakhs” is another popular search category. Tailor your campaigns to address the specific needs of the buyers. Offer solutions for first-time buyers and low credit score borrowers.

4. Go beyond English

The home loan market isn’t just about numbers and algorithms; it’s about connecting with people on a deeper level. In a diverse country like India, that connection often shines through the use of local languages and dialects.

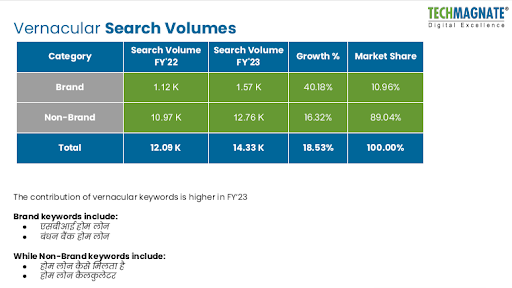

Vernacular searches are on the rise, presenting a rich opportunity for brands to reach borrowers in their most comfortable linguistic space.

- Vernacular searches for home loans have jumped by 42.1% in the past year, outpacing the growth of English searches. This trend highlights the growing comfort and preference for native languages online, especially among borrowers in Tier 2 and 3 cities.

- Top vernacular languages for home loan searches include Hindi, Marathi, Tamil, Telugu, and Kannada. Understanding and catering to these audiences opens doors to a massive audience.

Here’s how to embrace vernacular language and expand your reach:

- Create content in local languages. It could be blog posts, infographics, and videos in Hindi, Marathi, and other relevant languages. Address common search queries and provide valuable information tailored to local market conditions.

- Research popular vernacular keywords related to home loans and optimize your website and content accordingly. Tools like Google Keyword Planner can help you identify high-volume search terms in specific languages.

- Develop multilingual landing pages for different languages, featuring localized calls to action and contact information. This shows potential borrowers that you understand their needs and value their linguistic preferences.

- Partner with social media influencers and bloggers who speak the local language. They can create engaging content about your home loan offerings and reach a wider audience within your target communities.

5. Go app-friendly

In today’s mobile-first world, borrowers are increasingly turning to their smartphones to explore and compare home loan options. This shift to app-based searches presents a unique opportunity for brands to meet them where they are, literally in the palms of their hands.

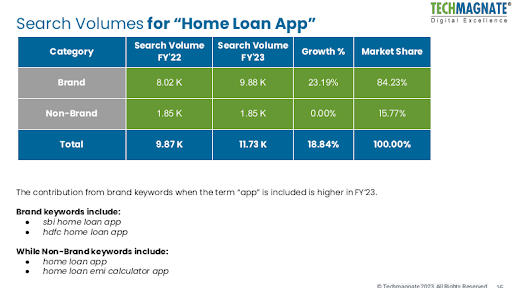

- Search volume for “Home Loan App” experienced a significant growth of 18.84%, indicating increased interest in mobile-based home loan solutions.

- Brand vs. Non-Brand: Interestingly, the contribution from brand keywords like “sbi home loan app” and “hdfc home loan app” has increased in FY’23, accounting for 84.23% of the market share. This suggests a shift towards brand-specific searches for home loan apps. With this in mind, lending institutions must reinforce their branding efforts to build top-of-the-mind recall.

- Non-brand keywords like “home loan app” and “home loan emi calculator app” showed no growth in search volume, potentially signifying that users are increasingly focusing on specific brands for their app needs.

Here’s how to capitalize on app-based searches:

- Develop a user-friendly home loan app. Offer features like personalized loan quotes, EMI calculators, loan application tracking, and direct communication with loan officers. Ensure a seamless and intuitive user experience.

- Optimize for app store visibility. Use relevant keywords and compelling descriptions to ensure your app ranks high in app store searches. Highlight unique features and benefits to attract potential borrowers.

- Leverage push notifications. Send personalized notifications to app users with relevant updates, offers, or reminders. This keeps them engaged and informed throughout the home loan journey.

- Integrate app usage data. Gather insights from app usage patterns to understand user preferences, identify pain points, and refine your app’s features and marketing strategies.

The Key Takeaway from our Home Loan Search Trends Report

By harnessing the power of search trends, you can transform your home loan marketing from a game of chance to a strategic effort. You’ll attract the right customers, build trust, and ultimately, unlock the door to a growing business.

Use the data and watch your marketing efforts show quantifiable results in the home loan market. Remember, in the competitive world of home loans, the key to success lies in understanding what your customers are searching for, and then delivering it with conviction.

Contact us today for a detailed discussion on how to leverage these search insights for a successful home loan marketing strategy.