Motor Insurance Marketing Strategies: Unleashing the Potential of Organic Search

October 20, 2023

Rudra Kumar

Summary: This blog post gives insights and trends in the motor insurance industry for the fiscal year 2022-2023 in India.

In our quest of exploring insurance marketing, we will cover one niche insurance industry – the motor industry and delve into the trends, insights and strategies that define this industry’s approach to reaching and engaging its target audience.

In today’s time when a digital presence is mandatory , insurance companies are finding new and smart ways to reach people. And one strategy that doesn’t get enough attention is “organic search.”

Sarvesh Bagla, the CEO and Founder of Techmagnate speaks on the importance of organic visibility for brands. He says,”The search volumes in the insurance sector have experienced remarkable growth, making it a compelling choice for organic investment. It’s not just about the demand for financial services; there has been a steady rise in financial literacy as well.

With consumers consistently turning to online sources for answers, appearing in organic search results can help establish trust with your brand. Companies that recognize the significance of enterprise SEO are positioned to generate substantial organic traffic.”

He further says, “At Techmagnate, we recognize that a deep understanding of search behavior is the foundation for successful Enterprise SEO campaigns. That’s why we dedicated ourselves to creating the Automobile Insurance Search Trends Report.

This report explores the evolving customer behavior and how brands can harness these trends to enhance their digital presence.”

Significance of Online Search Behavior for Insurance Companies

We know that online search behavior is the initial step in a potential policyholder’s insurance journey. It is the gateway through which a person explores options, evaluates coverage, and assess premiums.

For insurance companies, understanding and leveraging this behavior is essential for reaching their target audience effectively.

When a potential policyholder types in relevant keywords or questions related to insurance, search engines deliver a list of search results that include links to insurance providers, comparison websites, and informative articles.

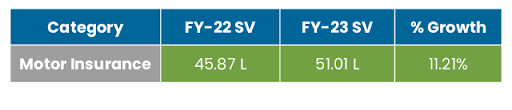

By analyzing the report we can see the transition from FY 2022 to FY 2023 for the motor insurance search volumes in India reflects significant shifts. Like an overall increase of 11.21% in search volume is indicative of the growing importance of motor insurance in the country.

Several factors contribute to this growth, including heightened awareness regarding insurance, the expanding automobile sector, and increased internet accessibility.

Brand vs. Non-Brand Search Trends

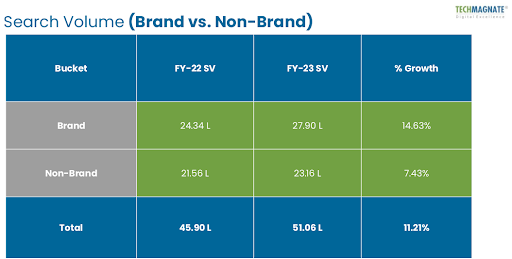

In the domain of motor insurance search trends, a crucial bifurcation emerges in the form of branded and non-branded search terms. Branded keywords encompass specific brand names or terms directly associated with a particular insurance provider, such as “TATA AIG car insurance” or “Policy Bazaar.”

Non-branded keywords, on the other hand, are more general and do not directly reference any particular brand, such as “bike insurance renewal” or “car insurance near me.” This distinction is pivotal as it signifies the difference between a customer actively seeking a particular insurance company and a potential customer in the early stages of their insurance journey, exploring general insurance-related queries..

Branded keywords often drive a substantial portion of search queries in the motor insurance sector. Users looking for a specific insurance provider or those already familiar with a brand may directly use branded terms in their searches.

On the other hand, non-branded keywords, while contributing to the broader search volume, reflect potential customers who are at earlier stages of their insurance exploration.

By focusing on branded terms, insurance companies aim to capture users who are actively considering their services. However, an effective online strategy must also encompass non-branded keywords to cater to potential customers who are in the early stages of research and decision-making.

Enquiry Type Analysis

Insurance Inquiry Types: Renewal, Claim, and New Insurance

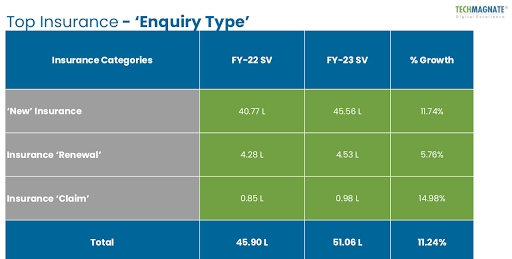

1. Renewal Enquiries: They typically involve questions about extending policies, making premium payments, and maintaining current coverage.

2. Claim Enquiries: These questions relate to how to submit claims, what documentation is needed, and the steps to receive compensation after an accident or damage.

3. New Insurance Enquiries: They seek information about available policies, coverage choices, and premium rates that suit their needs.

Among these types of enquiries, “new” insurance enquiries stand out due to their notable growth and importance in recent times. The data shows that “new” insurance inquiries have experienced significant year-on-year growth. For insurance providers, recognizing and catering to this surge in “new” insurance inquiries is crucial for tapping into untapped market potential and staying ahead from their competitors.

Top-Performing Motor Insurance Brands and Their Year-Over-Year Performance

| Top Motor Insurance Brands by Search Volume |

Results |

| 1. Policy Bazaar |

– Consistent high search volume |

| 2. ACKO |

– Attracting a significant number of searches |

| 3. ICICI Lombard |

– Substantial search volume; growing interest |

| 4. TATA AIG |

– Noteworthy search volume, strong online presence |

| 5. HDFC Ergo |

– Significant search volume; among top brands |

| Brands |

Performance Trends |

| Policy Bazaar |

– Maintained high search volume, consistent performance |

| ACKO |

– Slight decrease in search volume, but remains top performer |

| ICICI Lombard |

– Experienced growth in search volume, increased interest |

| TATA AIG |

– Witnessed a decrease in search volume, but maintains a strong position |

| HDFC Ergo |

– Slight drop in search volume, still among top brands |

– Policy Bazaar: Consistently maintains high search volume, demonstrating effective online marketing and strong brand recognition.

– ICICI Lombard: Increased search volume, showing success in adapting to changing search trends and attracting more potential customers.

Variations in Search Behavior (City-wise)

Search behavior in India exhibits distinct patterns across its cities. Major urban centers such as Mumbai, Delhi, Chennai, and Kolkata often experience higher search volumes due to their larger populations and extensive internet access.

Several factors contribute to regional variations in search behavior. Population size and demographics play a significant role, with larger cities naturally driving more online activity. Economic factors, including income levels and industry concentration, impact search trends.

Concept of Share of Voice and Its Importance in Search Marketing

Share of Voice (SOV) is a metric used in marketing to assess a brand’s or company’s presence and visibility in a particular advertising channel, such as search engines, compared to its competitors. In the context of search marketing, SOV measures the proportion of a brand’s online presence (ad impressions, search results, or content) compared to the total online presence of all competitors in a specific category or industry. It is typically expressed as a percentage.

The importance of SOV in search marketing lies in its ability to gauge the competitiveness and effectiveness of a brand’s digital marketing strategy. Here are some key aspects of its importance:

– Competitive Analysis: SOV analysis helps companies understand how they stack up against their competitors in the online space. This information is crucial for making data-driven decisions about budget allocation and strategy.

– Brand Awareness: A higher SOV indicates greater brand awareness and visibility. This can lead to increased organic traffic, customer trust, and ultimately, conversions.

– Market Share: SOV is often linked to a brand’s market share. A larger share of voice can be indicative of a larger market share, and companies can use SOV insights to set targets for market growth.

– Budget Allocation: SOV data can guide advertising spend. Companies can adjust their budgets to increase their share of voice if they aim to capture a larger portion of the online market.

Top Brands with the Highest SOV on Search Engines

Based on the data provided, the top brands with the highest SOV on search engines in the motor insurance industry are:

1. Policybazaar – 98.61%

2. ACKO – 84.67%

3. ICICI Lombard – 76.70%

4. TATA Aig – 42.37%

5. HDFC Ergo – 38.58%

These brands have successfully captured a significant portion of the online visibility within their industry, indicating strong brand presence and potentially higher market share.

How SOV Impacts an Insurance Company’s Marketing Strategies

Looking at the data now we can say Share of Voice has a substantial impact on an insurance company’s online visibility and, by extension, its overall success in the digital marketplace:

– Competitive Advantage: A higher SOV implies a stronger competitive advantage. Companies with a larger SOV are more likely to attract the attention of online users searching for insurance-related information or services.

– Brand Trust: Greater online visibility enhances brand trust. When a company consistently appears in search results and ads, it signals reliability to potential customers, which is vital in the insurance industry.

– Organic Traffic: High SOV often results in increased organic traffic to the company’s website. People are more likely to click on search results or ads from brands they recognize.

– Conversion Rates: Companies with a significant share of voice are likely to experience higher conversion rates. This is because their presence throughout the customer journey, from awareness to decision-making, can lead to more successful interactions.

– Market Growth: A strong SOV can contribute to a company’s market growth. It can attract new customers and increase market share by capitalizing on the increased visibility.

Implications for Motor Insurance Providers

1. Competitive Landscape: The motor insurance industry in India is highly competitive, with several established brands and aggregators. Providers must stay vigilant and adaptive in their marketing strategies to maintain and increase their market share.

2. Brand Visibility: A strong online presence is vital for brand visibility and trust. Providers with high SOV are likely to enjoy higher conversion rates and market growth.

3. Market Segmentation: The trend in “Private Vehicles” search volume suggests that providers should tailor their marketing strategies to cater to this segment’s specific needs and preferences.

4. Enquiry Types: The focus on “New” insurance indicates a potential demand for policies related to new vehicle purchases. Providers should capitalize on this trend by offering attractive packages for new vehicle owners.

How to Leverage These Search Trends for Successful Insurance Marketing Strategies

1. Invest in Brand Visibility: Motor insurance providers should allocate budget resources strategically to increase their share of voice. This can be achieved through targeted ad campaigns, content marketing, and SEO efforts.

2. Segmentation Strategies: Providers should analyze search trends and segment their offerings to align with customer preferences, whether it’s for private vehicles, commercial vehicles, or specific insurance types like comprehensive or zero depreciation policies.

3. Enhanced Online Experience: Ensuring a seamless and user-friendly online experience is crucial. Websites and mobile apps should be optimized for search, making it easy for potential customers to find and engage with the brand.

4. Content Marketing: Create high-quality, informative, and engaging content that addresses common insurance queries and concerns. This can help establish the brand as an authority in the field and boost organic search rankings.

5. Regional Focus: Consider regional variations in search trends. Tailor marketing campaigns to local preferences and needs in different cities.

6. Customer Engagement: Engage with customers through social media, chat support, and other online platforms to build trust and offer assistance during the decision-making process.

With an ever-increasing number of consumers turning to the internet to research, compare, and purchase insurance, the need for data-driven insights has never been more critical. As we’ve explored in this search trend report, the value of harnessing search trends and Share of Voice (SOV) analysis is paramount for effective insurance marketing strategies. Data-driven insights provide a clear roadmap for insurance companies to navigate this shift successfully.

Our report will help you understand the essence of customer behavior, preferences, and search patterns if your industry, and insurance providers can adapt and refine their strategies to meet the evolving needs of their audience. Download the report.