The Power of SEO in Health Insurance: Key Findings from Our Search Trends Report

October 23, 2023

Sarvesh Bagla

Summary: The blog discusses the role of SEO in India’s growing health insurance sector, where online searches play a crucial role in decision-making. It also highlights key findings from a comprehensive report, including the rise in specific health insurance search terms and the importance of digital marketing in this sector.

By 2026, it is expected that India’s growing health insurance sector will be worth a significant $222 billion. The country’s growing middle class and rising income levels are the main drivers of this growth. This large market increase can be attributed to the growing demand in obtaining comprehensive health insurance coverage as people’s financial situations improve and the middle class expands.

Online searches are frequently the first step in Indians’ decision-making when it comes to health insurance. They use search engines to research different insurance plans, learn more about various insurance providers, and make informed decisions about the best coverage for their needs. Understanding how people search online is crucial for companies looking to effectively advertise their health insurance plans in this evolving landscape.

In this blog, we will delve into the critical importance of SEO in the health insurance sector and understand the key findings from our comprehensive report.

Health Insurance Searches: What People Are Looking For

Within health insurance, the most searched medical phrases often revolve around high-risk or expensive treatments. People search for a variety of information, from disease symptoms to finding the right provider.

Common searches include:

- “Health insurance coverage for pre-existing conditions”

- “Affordable health insurance plans”

- “How to compare health insurance policies”

- “Best health insurance companies in [location]”

To attract more patients, health insurance companies must invest in SEO to rank higher in search results. Top SEO strategies include optimizing product pages, creating accurate medical content, and adjusting branded searches.

Businesses can also improve organic performance by creating quality content, optimizing for local searches, and focusing on technical, content, user experience, and mobile SEO.

Understanding User Intent

The motivation behind a user’s search query is referred to as user intent. It can vary greatly when searching for health insurance. For instance:

- Informational Intent: Users seek information about a medical condition or treatment options.

- Navigational Intent: Users want to find a specific health insurance provider or website.

- Transactional Intent: Users are looking to schedule appointments, purchase health products, or access healthcare services online.

Recognizing user intent is essential because it helps customize digital content and services to precisely match what searchers are looking for, improving their experience. This alignment is particularly important in the context of SEO, ensuring that content meets users’ needs and ranks well in search results.

Analyzing Search Trends

Monitoring search trends can benefit health insurance organizations by providing insights into what their target audience is searching for. It allows them to stay ahead of the curve by adapting their content and services to meet changing user needs. Staying up-to-date with these trends can provide valuable insights into evolving healthcare concerns, treatments, and patient preferences.

By analyzing search trends, health insurance providers can create content that aligns with their target audience’s needs and improve their reach.

Regional Variations in Search Trends

Search trends can indeed vary by location, and insurance providers should acknowledge these regional nuances in order to tailor their SEO strategies accordingly. For example, the healthcare needs and preferences of urban and rural populations can differ significantly, emphasizing the importance of location-specific SEO strategies.

The Importance of SEO Strategy for Health Insurance: Insights from the Techmagnate Report

A strong SEO strategy can lead to increased visibility and greater traffic to provider websites. Moreover, providers can also attract new clients through focused SEO efforts. Providers can distinguish themselves from their competitors, ultimately allowing them to dominate search results and get access to a greater market share.

The Search Trends Report from Techmagnate is designed to equip health insurance organizations with actionable insights to optimize their online presence effectively. While we’ve provided key findings in this blog, we do recommend that you download the full report to fully understand changing consumer behavior shaping the industry.

The report also highlights the leading health insurance providers and explores various opportunities, such as query volume, branded and non-branded keywords, share of voice, and growth prospects.

For companies in the health insurance sector looking to make the most of search engines, it’s a helpful tool.

Key findings from the report

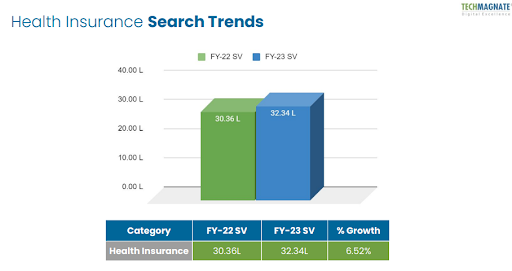

- The report uncovers common healthcare-related search queries, showing how more people searched for “Health Insurance” this year, and the searches for this category increased by 6.62% compared to last year.

- People searched for specific health insurance terms more than for well-known brand names.

- The top 3 fastest-growing health insurance categories in searches were Maternity Insurance, Senior Citizens Medicover, and Accidental Insurance.

- Three out of the top 11 brands saw their SV (Search Volume) increase by more than 20% compared to the previous year.

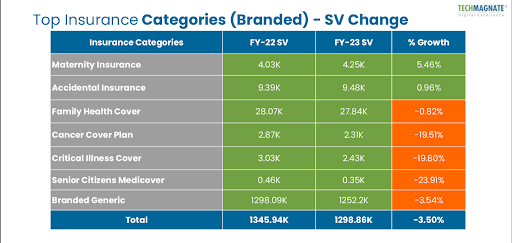

This analysis looks closely at the most popular insurance categories, especially the well-known ones, to show how search volumes have changed from FY-22 to FY-23. By studying the growth rates and important findings, we can better understand how the health insurance market is changing over time.

The increase in search volume for accident insurance and maternity insurance over the previous year (YoY) is a reflection of changing consumer choices and the dynamic nature of the health insurance sector.

The rise in maternity insurance sales suggests that expecting families are becoming more aware of the importance of full security during this significant life event and desire to plan for it well in advance.

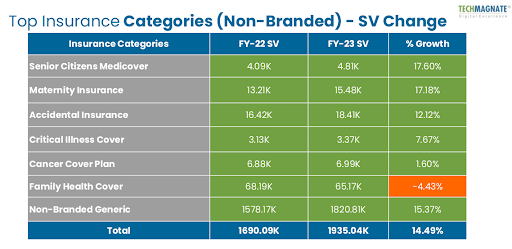

For non-branded keywords, the total search volume for all categories experienced a 14.49% growth. The search volume for Family Health Cover declined by 4.43% and Generic insurance saw a 15.37% increase in search volume.

We have noticed that a shared keyword between both branded and non-branded categories is “Maternity Insurance,” in addition to “Senior Citizens’ Medicover” and “Accidental Insurance.”

This highlights the growing demand for medical insurance related to women and pregnancy, which is influencing the insurance sector. It underscores the need for insurance companies to consider offering more policies catering to this specific search trend.

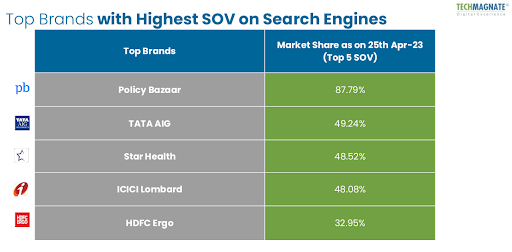

Speaking of brands, as of April 25, 2023, the top brands that have the greatest Share of Voice (SOV) on search engines are shown in the table.

1. Policy Bazaar holds the highest position with a substantial SOV of 87.79%, indicating its significant dominance in search engine results.

2. TATA AIG follows with a SOV of 49.24%, showing a notable online presence in comparison to other brands.

3. Star Health, ICICI Lombard, and HDFC Ergo also command a substantial SOV at 48.52%, 48.08%, and 32.95% respectively, reflecting their strong visibility and prominence in search engine outcomes. These rankings suggest that these brands are prominent and highly visible to users when they search for insurance-related information on the internet.

The report also reveals a year-over-year (YoY) comparison of search volume (SV) in Tier 2 cities for the specified fiscal years, providing insights into the changing local search landscape.

This data highlights the increasing local interest in online insurance-related searches in these regions, showcasing the potential effectiveness of local SEO strategies in targeting these markets.

| City |

SV Increase |

FY-22 SV |

FY-23 SV |

| Lucknow |

21.01% |

88.82K |

107.48K |

| Nagpur |

16.87% |

58.08K |

67.88K |

| Indore |

6.69% |

92.1K |

98.26K |

| Coimbatore |

5.71% |

87.02K |

91.99K |

| Jaipur |

5.53% |

58.73K |

61.98K |

| Surat |

5.52% |

55.94K |

59.03K |

| Ludhiana |

-0.38% |

47.01K |

46.83K |

| Visakhapatnam |

-0.98% |

36.76K |

36.4K |

| Bhopal |

-7.33% |

41.45K |

38.41K |

| Other Tier-2 Cities |

-5.07% |

365.98K |

347.41K |

| Total Tier 2 Cities |

2.27% |

977.8K |

999.95K |

On the other hand, cities like Bhopal experienced a notable decline in SV, decreasing by -7.33%. This further shows the significance of implementing local SEO efforts to address declining search volumes in such areas.

When considering all Tier 2 cities as a whole, the 2.27% increase in SV indicates a general upward trend in online insurance-related searches in these regions, underscoring the value of local SEO optimization as a key component of insurance marketing strategies in these cities.

Research Background

We thoroughly examined search phrases using first-party information from Google. The information, which covered the fiscal years FY-22 and FY-23, allowed for a full analysis and gave a complete overview of shifting trends in the market for health insurance.

- The research offers a solid platform for insights with a dataset that includes 7,378 keywords and an outstanding 32.33 lakh search volume, as of April 25, 2023, using Google’s Keywords Planner.

- Additionally, the dataset used in the research utilized geo-targeting with a focus on throughout India, which was carefully divided into Tier 1 and Tier 2 cities.

- A sample size of 55 well-known companies, each boasting significant search traffic, was carefully selected and examined as part of the research to ensure the accuracy and relevance of the findings.

This systematic approach ensured that the conclusions drawn from this research are not only comprehensive but also representative of the many facets of the health insurance business in India, providing useful data for both industry stakeholders and decision-makers.

Curious about the future of health insurance? Go ahead and download our Health Insurance Search Trends Report.