Dynamics of Auto Finance: Key Search Trends Shaping the Industry

November 29, 2023

Rudra Kumar

Summary: This blog post gives search trends insights in the auto finance industry for the fiscal year 2023.

The auto finance industry is experiencing a digital revolution as consumers increasingly turn to online platforms for information and decision-making. This shift in behavior is evident in the evolving landscape of auto finance search trends. To stay ahead in this dynamic industry, it is essential to understand the key trends shaping the future of auto finance.

Techmagnate is committed to staying at the forefront of industry insights to better understand consumer behavior. To gain insights into auto finance search trends, we conducted a comprehensive study using Google’s Keyword Planner, focusing on search volumes in India and specific cities. Our analysis went beyond the Play Store to encompass all app-related keywords and included search volumes for Hindi, where available.

Our CEO Sarvesh Bagla emphasizes using organic search results for effective digital marketing strategies. He says, “Organic search can help businesses connect genuinely with their audience. When companies improve their content and user experience, they tap into organic search to not only get more visitors but also build real relationships and trust. It’s how they succeed in the digital world, where being valuable and relevant matters most.”

Auto Finance Search Trends: A Techmagnate Report

1. Rising Prominence of Non-Brand Keywords

Non-brand keywords, such as “car loan interest rate” and “vehicle loan EMI calculator,” are increasingly dominating auto finance searches. This trend indicates a growing preference among consumers to conduct thorough research and compare options before making a financial decision. Auto finance providers should focus on creating informative and engaging content that addresses these non-brand queries to capture customer attention and establish their brand as a trusted resource.

For instance,

- Car loan brands could develop comprehensive guides explaining how car loan interest rates work, outlining factors that influence rates, and offering tips on securing the best rates.

- Interactive tools like an EMI calculator widget on their website can help users estimate monthly payments based on different loan terms and interest rates.

- Infographics comparing various loan options or video tutorials simplifying complex financial concepts can also engage and educate potential customers.

These content types not only address specific non-brand queries but also establish the provider as a reliable source of valuable information in the auto finance space.

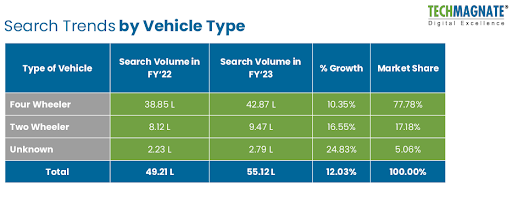

2. Diversification of Vehicle Preferences

Four-wheelers continue to hold a significant share of auto finance searches, but there is an emerging interest in two-wheelers, particularly in urban areas. This trend can be attributed to factors such as affordability, traffic congestion, and parking challenges. Auto finance providers should cater to this growing demand for two-wheeler financing by offering tailored products and services that meet the unique needs of two-wheeler enthusiasts.

Furthermore, in the latest data for FY’23, more individuals were seeking information about both new and used cars. The search for brand-new cars surged significantly, securing the search share at 94.16%. Meanwhile, searches for used cars also increased, although they accounted for a smaller portion at 5.84%. This indicates that people are

exploring options in both new and used cars, hinting at a shift in what individuals consider when looking to buy a car.

3. Understanding Regional Variations

Search trends exhibit regional variations, with cities like Bengaluru, Delhi, and Hyderabad leading in search volumes. Auto finance providers should consider these regional preferences when tailoring their marketing strategies. Localizing content, addressing regional language needs, and understanding local market dynamics can significantly improve the effectiveness of marketing campaigns.

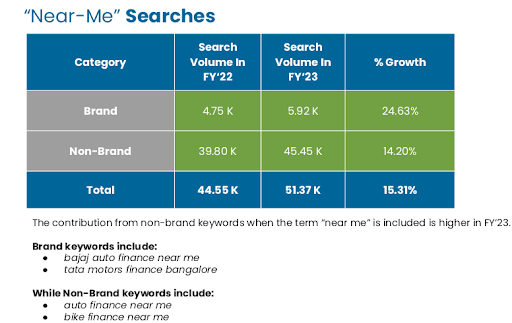

4. Leveraging the Power of “Near-Me” Searches

The use of “near-me” searches in auto finance queries is increasing, highlighting the importance of local search optimization and geo-targeting. Auto finance providers should ensure their websites and online platforms are optimized for local search results and provide clear information about their local branches and services.

5. Adapting to Mobile Dominance

A significant portion of auto finance searches occur on mobile devices, emphasizing the need for mobile-optimized apps and seamless user experiences. With auto finance searches mainly happening on mobile devices—just check out how the searches for the ‘Auto Finance App’ jumped from 1.67 thousand to 2.27 thousand between FY’22 and FY’23, a big 35.93% growth—it’s super important for auto finance providers to focus on mobile-friendly websites.

Even those non-brand keywords related to ‘app’ went up a bit, from 2.49 thousand to 2.54 thousand. Overall, the total searches went from 4.16 thousand to 4.81 thousand. It’s a clear signal for providers to make sure their online spots work great on mobiles. That means making them fast, easy to use, and adaptable to different phone screens. It’s all about giving users a smooth experience and making things easier for them.

6. Embracing the Impact of Digital Technologies

The adoption of digital technologies, such as chatbots and AI-powered tools, is transforming the auto finance customer journey. These technologies provide personalized interactions, enhance customer service, and streamline the loan application process. Auto finance providers should embrace these technologies to provide a frictionless and customer-centric experience.

7. Harnessing the Power of SEO

For auto finance search trends, using SEO is super important as more people search online for finance info. It means tweaking websites to rank better in searches. This helps individuals find what they need—like details about car loans or interest rates—easily. Doing SEO well helps auto finance companies stand out when people search for these queries. It brings more visitors to their sites and makes them more noticeable online where things are really competitive.

Additional Read: What is SEO

The top 5 brands, including HDFC Bank, ICICI Bank, Axis Bank, BankBazaar, and IDFC First Bank, hold the most visibility on Google. Their presence at the top is a result of their effective use of SEO (Search Engine Optimization) strategies. This means they’ve optimized their online content in ways that Google likes, making it easier for people to find them when searching for banking-related information. So, whenever someone looks up banking queries on Google, these brands are among the first ones they see.

8. Utilizing Personalized Recommendations

Data analytics and machine learning are enabling auto finance providers to offer personalized recommendations and tailored loan options based on individual customer profiles and preferences. Auto finance providers should utilize these data-driven insights to provide customers with relevant and timely recommendations, enhancing their overall experience.

9. Promoting Financial Wellness

There is a growing emphasis on financial wellness in the auto finance industry, with lenders providing educational resources and tools to help customers make informed financial decisions. Auto finance providers should prioritize financial wellness initiatives by offering financial literacy resources, budgeting tools, and credit counseling services.

By understanding and adapting to these key auto car loan search trends, auto finance providers can effectively navigate the evolving digital landscape, optimize their online presence, and effectively reach their target audience. Embracing these trends will be crucial for success in the ever-changing world of auto finance.

To further gain in-depth knowledge about what consumers search for in auto finance, download the report today.