Personal Loan Market: Uncovering Search Trends & Consumer Insights

December 14, 2023

Sarvesh Bagla

Summary: This blog post gives detailed insights from Techmagnate’s Personal Loan Search Trends Report FY’23.

The global market for personal loans, which reached $47.8 billion in 2020, is on track for a meteoric rise, projected to hit $719.3 billion by 2030. Over the next ten years, this translates to a jaw-dropping 31.7% compound annual growth rate (CAGR).

Such growth signifies a tremendous increase in the demand for personal loans worldwide, suggesting a significant shift in borrowing trends and financial behaviors among individuals globally. Therefore, it becomes extremely paramount for banks and lenders to understand what consumers are looking for in the personal loan market.

To understand these shifts and reach the right audience, we have worked on a comprehensive search report.

Techmagnate’s 2023 Personal Loan Search Trends Report delves into the shifting landscape of consumer behavior and preferences within the personal loan market. We analyze the latest search trends, contrasting them with data from 2022, to uncover the evolving needs, motivations, and pain points driving potential customers’ online inquiries.

Let’s dive into the latest consumer insights and search trends shaping the personal loan market in 2023.

5 Search Trends That Are Shaping the Personal Loan Market

The first and most prominent thing we cannot deny is the unrelenting demand for personal loans.

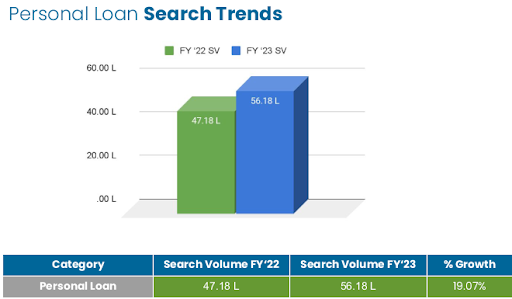

Search volume for “personal loan” on Google surged by

19.07% in FY’23 compared to FY’22, showcasing the growing need for financial flexibility among consumers. This growth is likely driven by various factors, including:

- Rising living costs: Inflation and economic uncertainty put pressure on household budgets, leading people to seek financial support for unexpected expenses or essential purchases.

- Greater financial awareness: Increased financial literacy and access to online resources are empowering individuals to explore loan options and manage their finances effectively.

- Evolving lending landscape: The rise of digital lenders and fintech platforms has made personal loans more accessible and convenient, breaking down traditional barriers to borrowing.

1. Shifting Brand Preferences

The search insights that hold significant importance in the personal loan market is the shift in preferences in terms of brand names.

While established players like HDFC Bank (26.59%) and Bajaj Finserv (4.67%) still hold significant market share, the search landscape reveals a growing interest in alternative lenders.

Bank of Baroda has emerged as a surprise contender, displacing ICICI Bank in the top 3 brands by search volume, thanks to a 161.58% year-over-year growth. Similarly, brands like Kotak Mahindra Bank, PNB, and L&T Finance have also shown impressive growth, indicating a shift in consumer preferences toward diverse lending options.

2. Purpose-driven borrowing

Consumers are increasingly seeking loans for specific purposes, with “Emergency Loan” (47.40%) and “Home Loan” (42.06%) topping the search charts.

Vehicle loans experienced a substantial 44.26% surge in search volumes, reaching 0.88K and securing a 4.31% market share. Other categories like marriage, debt consolidation, education, and vacation displayed varying levels of growth or decline, collectively contributing to the distribution of personal loan market shares. This highlights the practical and need-based nature of personal loan borrowing in today’s climate.

Additionally, there is a rise in searches for “Instant Personal Loan” (up 31.49% year-over-year) reflecting the demand for quick and seamless access to funds. People are also looking for personal loans with low credit scores, indicating a growing market for lenders who specialize in providing loans to borrowers with low credit scores. This highlights a potential business opportunity for lenders in this segment.

3. Location matters

City-wise data reveals interesting variations in search trends. Bengaluru (23.74% market share) emerged as the city with the highest search volume for “personal loans,” likely due to its vibrant tech and startup ecosystem, where personal loans play a crucial role in fueling entrepreneurial ventures and personal aspirations.

Other metro cities like Hyderabad, Delhi, Chennai, Mumbai, and Pune follow suit and also showcase a significant rise in interest for personal loans. This data reveals a golden opportunity for lenders to tailor their marketing efforts to these key cities, offering localized services and campaigns that resonate with the evolving needs and preferences of residents in each metro.

4. The Power of Apps

App-based searches are gaining significant traction, reflecting the growing preference for mobile-first experiences. Search volume for “personal loan” on Google Web Search, not just the Playstore, reveals a higher contribution from non-brand keywords when “app” is included. The contribution from non-brand keywords (96.36%) when the term “app” is included is higher in FY’23.

This indicates a shift towards personalized loan options accessible through user-friendly mobile apps. Borrowers don’t run after brand names anymore, they just want a seamless and user-friendly experience on an app for their financial requirements.

5. Personalization in search

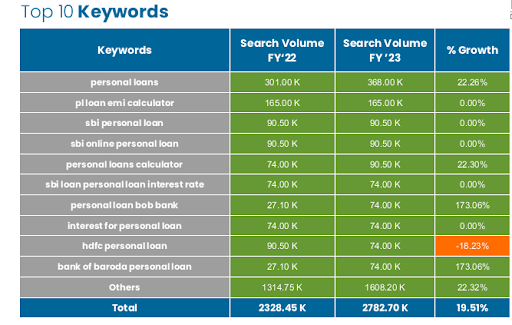

Borrowers are getting smarter! They’re searching for loans with clear features like

calculators and

low rates, not just the brand. Some banks like SBI are winning with targeted ads, while others like HDFC need a refresh. Smaller players can shine by understanding niche interests in the

“Others” category.

Additionally, the rise of “near me” and “app-related” searches indicates a growing emphasis on convenience and mobile-first experiences. The higher share of non-brand keywords (95.32%) in vernacular languages like Hindi suggests a shift towards local and personalized loan options.

What’s in the store for lenders? With the right SEO, transparency, and easy online apps financial institutions can attract borrowers based on their search type.

Did You Know! Techmagnate offers result-driven seo solutions to all business niches.

How Can Lenders and Marketers Leverage These Search Insights

These insights paint a clear picture of the evolving personal loan landscape. By understanding consumer needs and preferences, lenders can tailor their offerings to specific segments, leverage digital channels effectively, and provide personalized experiences. Marketers can capitalize on rising search trends, target relevant keywords, and develop localized campaigns to reach the right audience at the right time.

Let’s talk about strategy!

For Lenders:

- Talk affordability, not just rates. Highlight those loan calculators and EMIs in your services. Transparency is a new superpower.

- Segment smarter. Don’t just see borrowers, see loan seekers with dreams and questions. Use search data to personalize offers and speak directly to their needs.

- SEO? More like SEO-mazing! Use the keywords borrowers are searching for, then add them to your website organically. Google will redirect your website with loan-seeking traffic.

- Online apps are your friends. Make them smooth, fast, and available 24/7. Nobody likes a lagging loan application.

- Data is your compass. Use it to track progress, edit campaigns, and stay ahead of the curve. Borrowers are constantly evolving, and so should financial service providers.

For Marketers:

- Content is king, but targeted content is royalty. Create blog posts, videos, and infographics that address specific loan concerns.

- Keywords are your secret sauce. Find the ones borrowers are constantly searching for and reach their phone screens with targeted ads. Targeted campaigns are like bullseyes for loan seekers.

- Think global, act local. Use search data to understand regional needs and tailor your marketing messages accordingly. Borrowers in Bangalore have different dreams than those in Mumbai.

- Social media is your megaphone. Share informative content, answer queries, and run targeted ads. It’s all about building trust and becoming a valued loan service provider.

- Partnerships are power plays. Team up with financial influencers and platforms to reach a wider audience.

As the personal loan market continues to surge, staying informed about consumer insights and search trends will be crucial for success.

These are just snippets of information from the report, lenders and marketers can learn a lot more about consumer behavior from our detailed analysis of the search trends. They can position themselves to tap into this growing opportunity in the personal loan market and achieve their financial goals.

Download the report now.