Gold Loan Search Trends Report: State Of The Search Landscape In 2023

January 10, 2024

Neha Bawa

Summary: This blog post gives detailed insights from Techmagnate’s Gold Loan Search Trends Report FY’23.

Amongst all other commodities, gold still reigns supreme, especially with the looming global market recession with fluctuating markets and currencies. Gold continues to stay strong and is widely considered to be a consistent financial instrument.

India is one of the world’s largest consumers of gold as this precious metal holds a deep cultural significance, besides its monetary value.

As per the Reserve Bank of India (RBI), the country owns a whopping 27,000 tons of gold, which accounts for 14% of the total global gold.

Meanwhile, the gold loan market in India stood at US $55.52 billion in 2022 and is projected to take a massive jump at a compound annual growth rate (CAGR) of 12.22%, ending at a jaw-dropping US $124.45 billion by 2029.

The rising demand for gold loans can be seen in both individuals and MSMEs. Individual consumers are increasingly opting for gold loans to meet their needs, i.e. education, weddings, medical expenses, etc. Small businesses too have been showing increased interest in gold loans, as a secure means of raising working capital.

So, how do you leverage the evolving customer search behavior to take advantage of the search landscape for customer acquisition?

Techmagnate’s Gold Loan Search Trends Report for FY’23 gives a unique insight into the consumer’s search patterns, allowing banks, NBFCs, and online gold loan providers to tweak their digital marketing techniques to edge out the competition and expand their customer base.

The report examines how customer behavior is evolving and how your brand can leverage these trends to create a stronger digital presence.

The world of online search is a treasure trove of potential customers, waiting to be tapped, provided you are aware of what these users are searching for.

Understanding the user intent is key to identifying their needs and offering services to address them.

The Gold Loan Search Trends Report analyzed over 1,400 keywords focusing on brand and non-brand keywords, types & volumes of queries, and opportunities for growth for brands in the gold loan market in India. It also highlights the top-performing gold loan providers dominating Google Search.

Let’s now delve into the report and check these trends in detail.

The 5 Search Trends Key To The Gold Loan Market In India

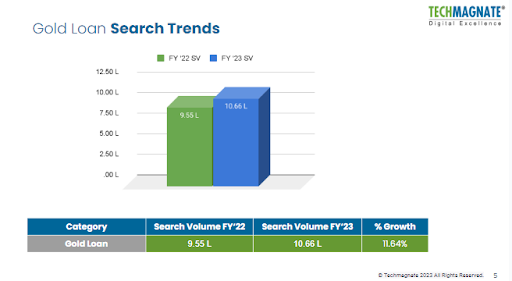

Searches for gold loans continue to rise

There’s been a significant surge in the searches for gold loans, with a year-on-year growth of 11.64%. For FY’23, the search volumes for gold loans witnessed an increase of 11.64% with 10.66 lakh searches, as against the 9.55 lakh searches in FY’22.

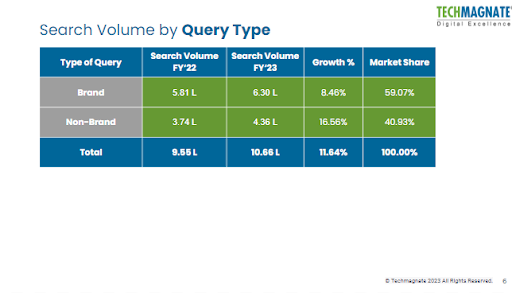

Brand awareness

Our analysis showed that branded and non-branded keyword searches experienced an encouraging rise with 8.46% and 16.56% search volumes, respectively.

Besides the increase in search volume, both keyword types captured a sizeable market share, with branded keywords at 59.07% and non-branded keywords at 40.93%

Major Indian banks and NBFCs have also experienced a significant rise in search volumes and market share capture. Bank of Baroda, HDFC Bank, and Union Bank of India have demonstrated greater than 30% yearly growth in brand search volumes

The Gold Loan Search Trends Report reveals the top 5 brands for gold loans, based on their search volumes. These are:

| Brand |

Search Volume (FY’23) |

Market Share (FY’23) |

| IIFL Finance |

175.64 K |

27.88% |

| Muthoot Finance |

90.83 K |

14.42% |

| State Bank of India |

56.58 K |

8.98% |

| Bank of Baroda |

54.63 K |

8.67% |

| Indian Overseas Bank |

41.71 K |

6.62% |

Despite the prevalence of mobile devices and the presence of mobile apps for gold loan providers, search volume and market share remained steady. This indicates that app usage for gold loans is growing but at a slow pace.

| Brand |

Search Volume (FY’23) |

Market Share (FY’23) |

| Manappuram Finance (OGL) |

3.30 K |

62.03% |

| Rupeek |

0.22 K |

4.14% |

| Gold Cash Ltd. |

0.21 K |

3.95% |

| IIFL Finance |

0.12 K |

2.26% |

| Muthoot Finance |

0.11 K |

2.07% |

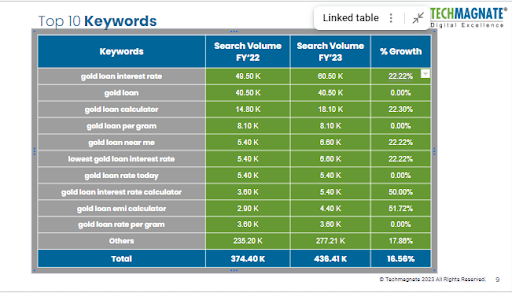

Top Gold Loan-Specific Keywords

The Gold Search Trends Report identified the top 10 keywords that were used to search for gold loans. These keywords will prove valuable for goal loan providers in understanding user behavior, thus enabling them to revisit their SEO and digital marketing strategies.

‘Gold loan interest rate’ and ‘gold loan’ have topped the table with 60.50 K and 40.50 K searches respectively, with the former showing a growth of 22.22% in searches

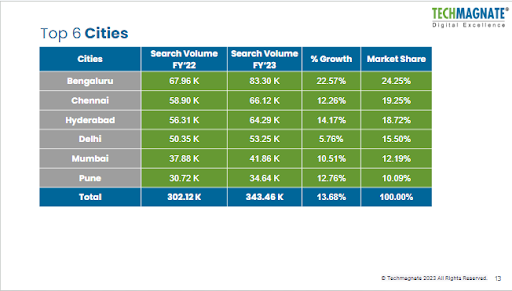

Metropolitans Ruled the Gold Loan Market in India

A key insight from the data shows that users from metropolitan cities have conducted the most gold loan searches. South India had the highest number of searches with Bengaluru and Chennai topping the list with 83.30 K and 66.12 K searches respectively.

The search figure not only indicates the users’ affinity towards gold in South Indian cities but also an increasing demand for gold loans.

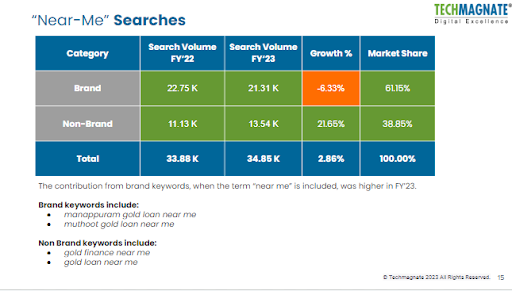

The Power of ’Near Me’ Searches

Keywords with ‘near me’ performed quite well with user intent focused on finding gold loan providers near their location. Brand keywords captured a bigger market share of 61.15% compared to non-brand keywords, with a market share of 38.85%

This indicates that the users are more likely to turn into customers if a brand’s presence is near their home or work.

- Example of brand keyword: Muthoot gold loan near me

- Example of non-brand keyword: Gold loan near me

Strategies For Gold Loan Providers To Dominate The SERPs

Based on the data and the analysis provided by Techmagnate’s Gold Loan Search Trends Report, here are a few strategies that brands can integrate into their digital marketing strategy to conquer the goal loan market in India.

High-volume keyword optimization

In the competitive gold loan market, ranking for high-volume keywords is crucial. Keywords like “gold loan interest rate”, “gold loan calculator”, and “gold loan near me” are commonly searched by potential customers. Creating content optimized for these keywords can significantly improve search engine rankings. This includes using these keywords in titles, headers, meta descriptions, and throughout the content in a natural, reader-friendly manner.

Local SEO optimization

With many users searching for gold loans in their vicinity, local SEO is a goldmine. This can be achieved by creating location-specific pages on your website and optimizing your Google My Business profile. This helps in appearing in local search results, making it easier for nearby customers to find your services.

Content marketing

Developing a robust content marketing strategy is key. This involves creating informative blog posts, guides, and FAQs that address common queries related to gold loans. This content should not only be rich in keywords but also provide real value to readers, establishing your brand as a knowledgeable and trustworthy source in the industry.

Mobile Optimization

With a significant portion of internet users accessing information via smartphones, having a mobile-optimized website is essential. This includes ensuring fast loading times, easy navigation, and a responsive design that adapts to different screen sizes.

Leverage vernacular SEO

India’s diverse linguistic landscape presents a unique opportunity for vernacular SEO. Creating content in regional languages like Hindi, Gujarati, Telugu, and Bangla can tap into a broader audience base, catering to non-English speakers who are looking for gold loan services.

Video Marketing

Videos can be an effective tool to explain complex topics like gold loan processes and interest rates. Platforms like YouTube provide a vast audience base. Embedding these videos on your website can enhance user engagement and provide a richer content experience.

Social media engagement

Utilizing social media platforms to engage with potential customers can increase brand visibility and trust. Regular posts, interactive sessions, and customer testimonials can be used to engage with the audience and provide them with valuable information.

Influencer partnerships

Partnering with influencers in the finance sector can boost credibility and reach. Influencers can help demystify gold loans and present your services to their followers in a relatable and trustworthy manner.

Remarketing campaigns

Remarketing is a powerful tool to re-engage visitors who haven’t converted. Displaying targeted ads to these users as they browse other sites can remind them of your services and encourage them to revisit your website.

Final thoughts

The FY’23 period saw a significant rise in gold loan search volumes, especially for terms related to interest rates and calculators, reflecting a more informed and cost-conscious consumer base.

The search trends suggest that key players in the market are gaining traction through strong brand presence and effective digital marketing strategies, as evidenced by the growth in brand-specific search volumes.

The market also exhibits regional variations, with cities like Bengaluru showing higher interest levels. Moreover, the trend of vernacular searches indicates the reach and appeal of gold loans across diverse linguistic demographics in India.

As the market continues to evolve, understanding and leveraging these search trends will be crucial for market players in the gold loan industry.